After travelling through India for a while and having to go through all the trials and tribulations of exchanging money, I googled this term to see if anyone had really written a comprehensive guide on the matter. Other than the same information you could get from Chat GPT, I couldn’t find anyone mentioning the on-the-ground information you need to know before you arrive. Things like which ATMs accept foreign cards? What are the charges? How to avoid those charges (as much as possible); and; which brand of ATMs are better and charge the least? In this guide, I will share exactly all of that with you. Despite a boring topic, it’s pretty useful if you’re staying here for a while.

Why trust me? I’ve lived in India as a foreigner for over a year now.

Updates to article:

22/05/24 – changed fees for withdrawals on some ATMs as advised by readers. added information about ING Australian card charging 9.5% for withdrawals.

ATMs & Foreign Cards in India

Most ATMs in India accept foreign cards. Visa, Mastercard, and American Express are widely accepted. However, smaller co-operative banks like City Union and Bank of Maharashtra may not. But don’t worry, as these are rare and make up less than 0.1% of India’s ATMs.

Stick to major banks like State Bank of India (SBI), HDFC Bank, ICICI Bank, and Axis Bank for secure and reliable transactions. They are widely available in urban areas, and you won’t have any issues finding an ATM in the big cities. When you’re planning for a trip to a more remote area, note that the ATMs can be scarce. Do your research well before heading there, like checking Google Maps for ATM locations in and around the area you’re planning to go to. If not, make sure to bring enough cash with you.

ATMs that accept most foreign cards are:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

There are other banks that you could try, but these are the most reliable ones and the ones from which you’re most likely to successfully withdraw cash

Important to note: if from Australia, AXIS will charge a 9.5% markup when using an ING card. Courtesy of Alan, a reader here at WHTC

Lowest Fee ATMs in India

| Bank | Foreign Transaction Charges | Taxes |

|---|---|---|

| SBI | Minimum of Rs. 100 | Plus GST 3.5% of the taxation amount |

| HDFC | Minimum of Rs. 125 | Taxes will be added (not specified) |

| ICICI | Minimum of Rs. 200 | No |

| Axis | Minimum of Rs. 125 | None, but some cards charge exchange markup |

| BOI | Minimum of Rs. 125 | Plus currency conversion charges (2%) |

| Punjab National Bank | Minimum of Rs. 150 | No |

| Yes Bank | Rs. 0 (FREE! | No |

Based on my own experience and reports by other travelers, SBI doesn’t charge extra fees. Further into the article, I’ll share one golden tip that will ensure that you always have the cheapest ATM available.

To Exchange Money At the Airport, Shop or just Withdraw?

There are 3 ways you could exchange money in India:

- Airport – the most expensive option

- Forex shop – better fees but many scams to be weary of

- ATMs – easiest option and actually charge lower fees than many forex shops if you use the right ATM.

The best way to withdraw cash is using an ATM with low fee charges. Something like an SBI ATM only charges RS100 ($1.5) for withdrawals, which is often less than you’ll find at any exchange or airport.

The easiest one would be exchanging your cash at the airport itself, as there are plenty of official reliable shops to do that. However, the exchange rates are very high, and you’d sometimes end up paying 10 – 15% more than you would at the exchange offices outside the airport.

Be careful when exchanging outside the airport, as scams are still a big problem in India, and you might end up paying more than you should.

A better place to exchange your foreign money would be authorized money exchangers – the ones approved by RBI. Because there are so many of these agencies all over India, they often offer great exchange rates due to competitiveness. Do make sure that you’re transacting with a licensed forex broker, they must have an AD-II and FFMC license.

Ask for proof of this at the exchange office, or check on Google ‘RBI-approved currency exchange near me’. Once at the office, check the exchange rate, and see what they offer. You can sometimes bargain a bit to make the rate better, however, this depends from place to place.

What Do I Do if The ATM Doesn’t Accept My Card?

A travellers biggest nightmare; the ATM doesn’t accept your card, and now you can’t get your hands on your own money. So, what should you do in such a situation? Here are some steps to try and solve the issue.

- Step 1: Try a different ATM. It might be that this specific ATM has some issue at that time and location, so try another one in the vicinity, preferably at another bank. Stick to the banks mentioned before.

- Step 2: Contact your local bank. If you’ve tried multiple ATMs and none of them seem to work, it might be a problem with your card. It’s best to inform your local bank about the issue, and ask for their help and advice. They might be able to solve the issue for you or offer guidance on other alternatives.

- Step 3: Exchange foreign currency. If you still have foreign currency at hand, go to a currency exchange office and get it exchanged, so you at least still have some money at hand.

- Step 4: Use Western Union or MoneyGram. If the issue can’t be solved, you don’t have any other card which works, and you’re completely out of both rupees and foreign cash, your best option would be utilizing international money transfer services like Western Union and MoneyGram. You can send yourself money from home, and you can collect it at a local branch for some fees. The estimated time to receive the money depends on several factors, which can be checked and confirmed at the sender’s end.

I personally had to do the Western Union transfer while in Pakistan as none of the banks will accept foreign cards there at all. It was as simple as transferring myself some money to my own account from home. It’s a very simple process, you just set up a Western Union account and wire yourself some money from your home bank account to pick up at any local shop that offers their services.

It took around 1-2 hours to get my money from home using Western Union in my India to Pakistan trip.

Pro Tip: Always keep emergency funds in multiple forms, such as cash and multiple cards, to make sure that you have financial flexibility in unexpected or emergency situations. I’d always recommend bringing a credit card along for emergency purposes.

Practical Ways To Avoid High Fees

We all want to get the most beneficial rates and pay as little fees as possible when getting that money out of the ATM machine. I’ve found some great ways to avoid those high fees and get your money in the cheapest way possible.

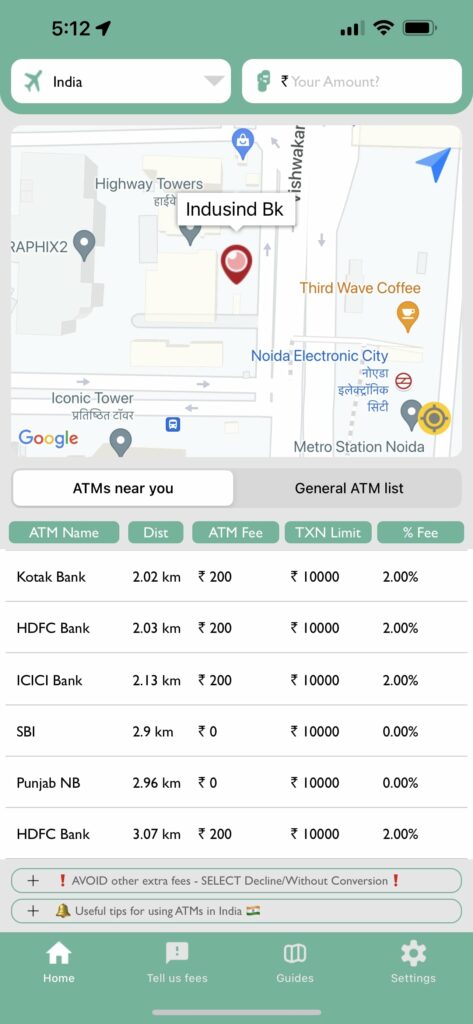

The ‘ATM Fee Saver’ App

Get your phone out, and download the app called ATM Fee Saver. It shows you all the ATMs near you, their withdrawal limits, and the amount of fees you’d have to pay to get your money out. It made my life much easier while travelling around, plus it saves you some of that hard-earned cash.

Get a Forex Card

Forex cards are an advantageous tool for international travel as they minimize the fees associated with foreign transactions. These cards are preloaded with foreign currency, eliminating the need for conversion during transactions and thereby avoiding currency conversion fees. By using a forex card, you can avoid the charges that are typically incurred with regular credit or debit card usage abroad, which makes them a cost-effective and convenient option for managing expenses while traveling internationally.

I personally use the Wise Debit card, which is a Visa card. It’s incredibly easy to get, you just go to their website, make an account, and order your own debit card for $9. Once you get it in your hands, you can choose the currency of the country you’re travelling to and start using it straightaway.

I haven’t had any issues, using my Wise card at the ATMs mentioned above. Some people also use Revolut (Harry, our site owner, does and says it works the same as Wise) and I’ve heard some great reviews about it, though I can’t say that I’ve used it personally.

While the Revolut card seems to work as well at most ATMs, some travellers have reported that Bank Of India doesn’t accept it, so look out for that one.

Avoid using Credit Card

Though credit cards with ‘no foreign transactions fees’ are increasingly common nowadays, do read the fine print. Some credit cards still charge about 3% or more on transactions made abroad.

Top tip: When you withdraw, the ATM usually asks you to consent to the offered conversion rate . If you decline, you’d still usually get your money, though at Visa’s own conversion rate that turns out to be better in most cases.

Can Foreigners Get A Bank in India?

Yes, foreigners and tourists are allowed to get a bank account in India. Indian banks offer a Non Resident Ordinary Account for foreigners and tourists. This NRO Account is allowed to be used for a maximum of six months. It allows tourists to deposit funds from abroad through the banking channel or from the sale of foreign exchange brought to India. With an NRO account, tourists can make local payments, however, payments exceeding INR 50.000 ($599.59) must be made by cheques, pay orders, or demand drafts. When it’s time to leave India, tourists are permitted to transfer the balance available back into their original accounts.

To get an NRO account, you’d need to furnish some documents such as your passport, visa, and proof of accommodation. The KYC procedure is required to open an acount, which is similar to the process you must have completed to get your SIM card in India.

I’m highly unsure how beneficial this option is, as you’re only permitted to have the account for up to six months. Even without a local bank account, you can still use your own Visa card almost everywhere. Additionally, you’d have to pay taxes on the interest earned on deposits in an NRO account, as any income on it is taxable according to Indian tax laws. You’d have to pay TDS, or tax deducted at source, on that interest, which might add to the overall charges of using a local NRO account. Apart from the applicable surcharge and cess, the interest earned on income in an NRO account is taxable at a rate of 30%.

If you’re working remotely in India and want to open an Indian bank account to deposit your salary, it can result in some consequences, especially if your visa doesn’t allow it. If you’re working and earning on your tourist visa, it’s important not to have an Indian bank account, or at least not get paid on one. You can find more information on that on the digital nomad visa guide.

State Bank of India (SBI) is often praised for its extensive network, providing easy accessibility across the country. Their foreigner-friendly services, including the availability of English-speaking staff and user-friendly online banking platforms, make it a preferred choice. HDFC Bank is the next best option for foreigners, as they offer specific services for non-residents, various expat-specific banking solutions, convenient internet banking, and a range of international banking services. These banks often provide diverse banking products and services catered to the needs of expats, making them the go-to choices for many living and working in India.

Jytte is a 22-year-old female adventurer from The Netherlands. She loves to fully immerse herself in the local ways of living, going ‘off the beaten path’ to truly experience the countries she visits and their unique way of life. Her wanderlust has taken her to Asia, with a particular focus on India. Here you’ll find her writing about all things India and Asia with a focus on digital nomadding there.

Hi give you a quick update on ATM fees we’ve encountered here in India.

1. ICICI – 200Rs ATM Fee

2. Punjab – 150Rs

3. Yes Bank – 0 Rs

4. Think Tried BOI but currency conversion fee was robbery and cancelled the transaction.

That’s all

Thanks for sharing and making this resource better for everyone Adrian! What nationality card are you using out of interest?

Axis charged me 9.5% “exchange rate markup ” today using an ING debit card from Australia. I’ll look elsewhere tomorrow!!

Thanks for letting us know Alan, we’ll update the article