If you’re planning a trip to Thailand or considering a longer stay as an expat, understanding how to navigate ATM withdrawals is crucial. This guide will walk you through everything you need to know about using ATMs in Thailand, from fees and exchange rates to tips for avoiding common pitfalls. If you have a Thai bank account it will also show you how to withdraw using only the app, so you don’t have to pay the extra fees for a debit card when opening a Thai bank account as a foreigner.

ATMs and Foreign Cards in Thailand

The good news is that all banks in Thailand accept foreign cards. Whether you have an AMEX, Visa, Mastercard, Maestro, or Union Pay card, you’ll be able to withdraw cash from Thai ATMs. However, it’s important to note that not all ATMs are created equal when it comes to fees, withdrawal limits, and exchange rates.

Important note: if you’re American, get a Charles Schwab card, they refund all fees on ATMs worldwide. Revolut, Wise and other travel cards do not reduce fees, however they may have better exchange rates than your bank. If you’re in the UK go for the Halifax Clarity card (it doesn’t refund fees, but you won’t be charged fees for using your card abroad).

Best ATMs for Foreigners in Thailand

While you can use any ATM you come across, some are more foreigner-friendly than others. Here are some of the best options:

- Krungthai Bank: Allows withdrawals up to 25,000 baht per transaction

- Bangkok Bank: Also offers a 25,000 baht withdrawal limit

- AEON Bank: Lowest transaction fee at 150 baht, but limited to 20,000 baht per withdrawal

- Siam Commercial Bank (SCB): Often offers the best exchange rates, but has a lower withdrawal limit of 10,000 baht

ATM Fees and Withdrawal Limits

One of the biggest concerns for foreigners using ATMs in Thailand is the fees. Most Thai ATMs charge a fee for foreign card withdrawals, which can quickly add up if you’re not careful. Here’s a breakdown of some common ATM fees and withdrawal limits:

| ATM Name | Transaction Charge | Withdrawal Limit (Baht) |

|---|---|---|

| AEON | 150 baht | 20,000 |

| Krungthai | 220 baht | 25,000 |

| Bangkok Bank | 220 baht | 25,000 |

| Siam Commercial Bank | 220 baht | 10,000 |

| Krungsri | 220 baht | 30,000 |

As you can see, AEON Bank offers the lowest transaction fee, but their ATMs can be harder to find. Krungthai and Bangkok Bank are often good choices due to their higher withdrawal limits, which can help you minimize the number of transactions (and thus, fees) you need to make.

Exchange Rates at Thai ATMs

Another important factor to consider when withdrawing money from Thai ATMs is the exchange rate. ATMs typically offer less favorable rates compared to currency exchange booths.

For example:

- ATM rates: Approximately 42-42.5 baht per £1 GBP or 33-33.5 baht per $1 USD

- Currency exchange booth rates: Can often be between 44-46 baht per £1 GBP or 35-35.5 baht per $1 USD

While the difference may seem small, it can add up over multiple transactions or for larger amounts. Siam Commercial Bank (SCB) often offers the best exchange rates among ATMs, but remember to factor in their lower withdrawal limit when deciding where to withdraw.

How To Withdraw Money From A Thai ATM (Using A Foreign Card)

To withdraw from the ATM using your home country’s bank as a foreigner:

- Use your credit or debit card (mastercard, visa, AMEX etc.)

- Put the card into the machine

- Enter your pin

- Choose the amount you’d like to withdraw

- Select cancel on the currency conversion that it suggests you (your banks will be better)

- Accept the 150-220 baht fee, and collect your cash

How To Withdraw Money From Your Thai Bank Account (No Debit Card)

You can withdraw money anywhere without a card in Thailand using the ATM of your designated bank, or partner banks that allow withdrawals. Some partner banks will charge fees for this service (usually fairly low 15-20 baht), but if you withdraw from your usual bank’s ATM, there are no fees.

To withdraw from the ATM using your Thai Bank account as a foreigner:

- Download your bank’s app & login to your account

- Click “cardless ATM” withdrawal

- Choose the amount you’d like to withdraw

- Go to an ATM that is the brand of the bank account you have

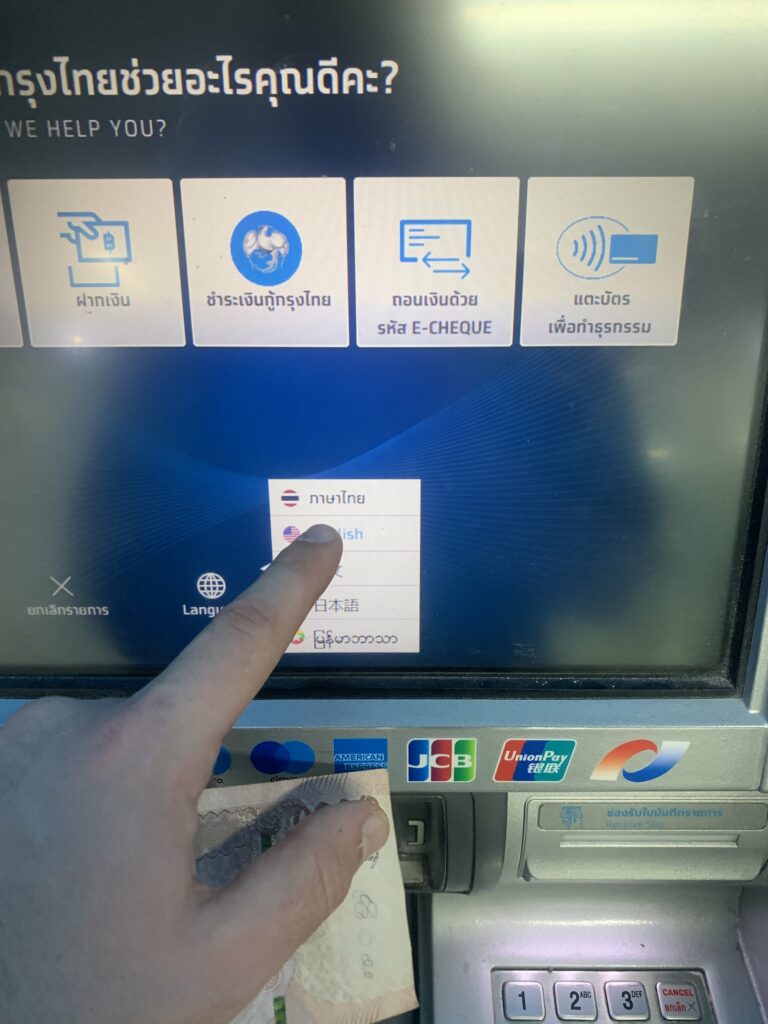

- Change the language to “English”

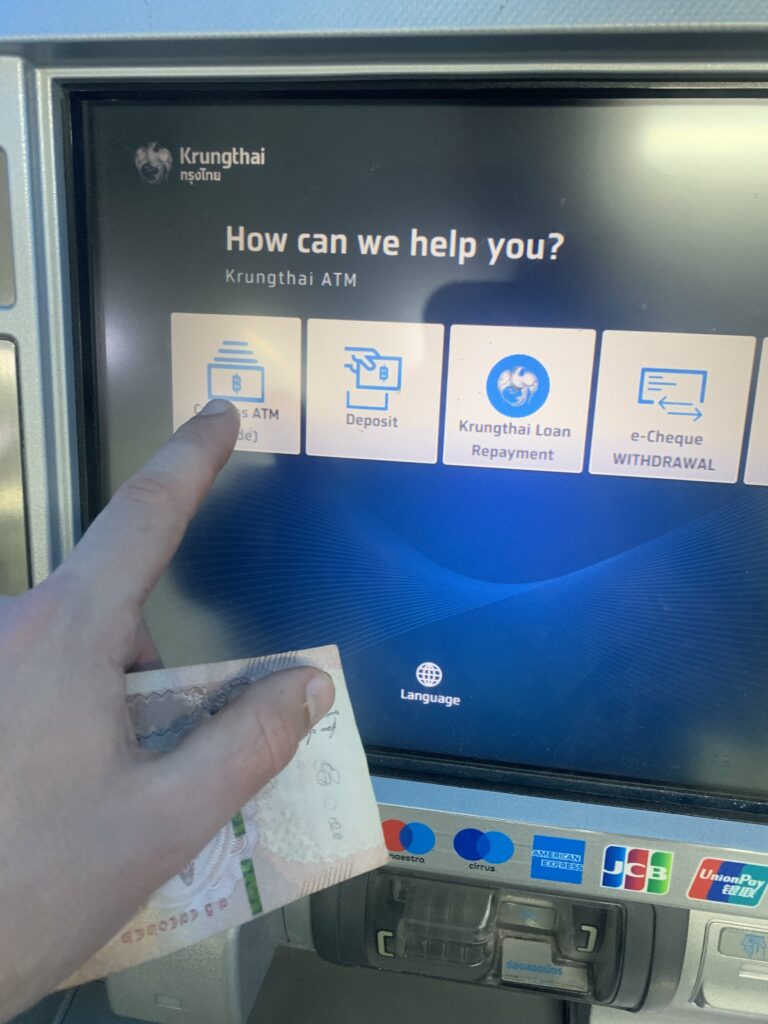

- Select “cardless withdrawal”

- Input your Thai phone number (you need a Thai SIM Card)

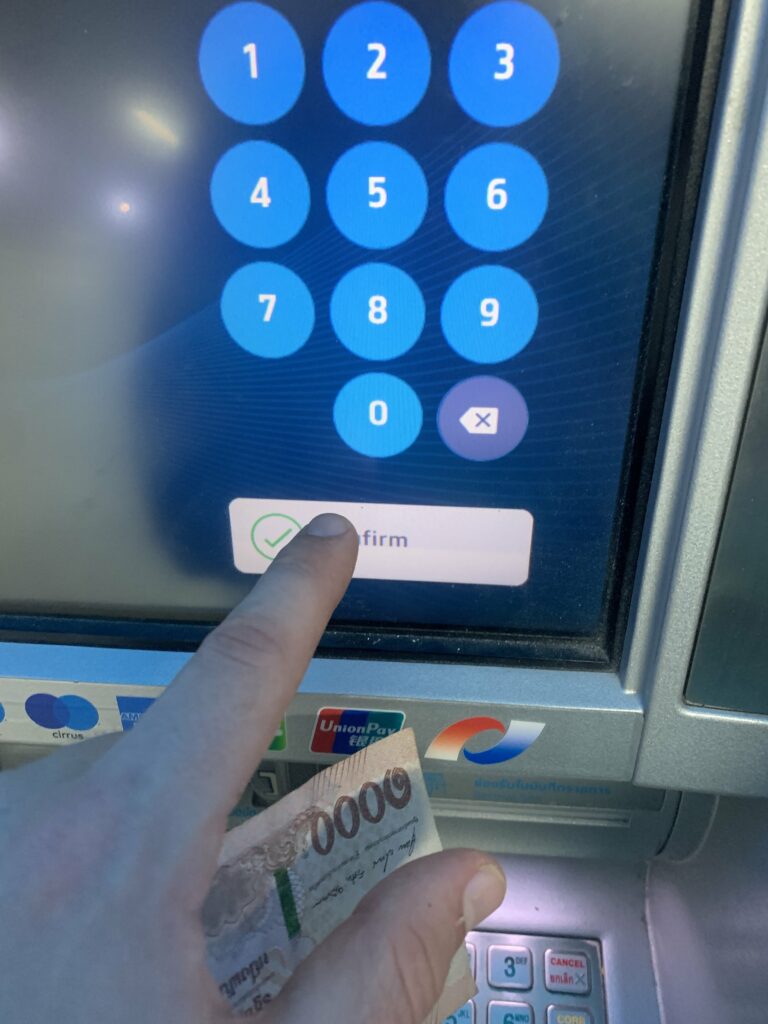

- Input the code that is presented on your app

- Collect your cash

Tips for Using ATMs in Thailand

To make the most of your ATM withdrawals in Thailand and minimize fees, consider the following tips:

1. Avoid Dynamic Currency Conversion

When using an ATM in Thailand, you may be asked if you want to complete the transaction in Thai Baht or your home currency. Always choose Thai Baht. Selecting your home currency activates dynamic currency conversion, which often results in a poor exchange rate and additional fees.

2. Make Larger, Less Frequent Withdrawals

Given the fixed fee per transaction, it’s usually more cost-effective to make fewer, larger withdrawals. For example, withdrawing 25,000 baht once from a Krungthai ATM is cheaper than making five 5,000 baht withdrawals from an SCB ATM, despite SCB’s better exchange rate.

3. Use ATMs in Safe, Well-Lit Areas

For your safety, always use ATMs in well-lit, busy areas, preferably inside banks or shopping malls. Be aware of your surroundings and shield the keypad when entering your PIN.

4. Notify Your Bank Before Traveling

To avoid having your card blocked for suspicious activity, inform your bank about your travel plans before leaving for Thailand.

5. Have a Backup Plan

It’s wise to have multiple ways to access your money. Bring at least two different cards from different banks, and consider carrying some cash or travelers’ checks as a backup.

Alternatives to ATM Withdrawals

While ATMs are convenient, they’re not always the most cost-effective option. Here are some alternatives to consider:

Currency Exchange Booths

Foreign exchange shops in Thailand often offer better rates than ATMs. If possible, bring some cash in your home currency and exchange it at these booths. You’ll find them in most tourist areas and shopping malls. Remember to shop around, as rates can vary between booths.

Opening a Thai Bank Account

If you’re staying in Thailand long-term, consider opening a Thai bank account. This can help you avoid foreign transaction fees and get better exchange rates. To open an account, you’ll typically need to prove residency in Thailand, which might require a work permit, student visa, or retirement visa.

Using International Money Transfer Services

Services like Western Union can be useful if your card doesn’t work in Thai ATMs or if you need emergency cash. These services allow you to transfer money from your home bank account to be picked up in cash at locations throughout Thailand. All you need is your passport to collect the money.

Cash vs. Card Payments in Thailand

While card payments are becoming more common in Thailand, especially in major cities and tourist areas, cash is still king in many places. Most small businesses, street vendors, and taxis only accept cash. Therefore, it’s essential to always have some cash on hand.

In more modern establishments like shopping malls, high-end restaurants, and hotels, you can often pay by card. However, be aware that some places may charge an additional fee for card payments.

Safety Tips for Carrying Cash in Thailand

Given the necessity of carrying cash in Thailand, it’s important to take precautions to keep your money safe:

- Use a money belt: Keep the bulk of your cash hidden under your clothes in a money belt.

- Divide your cash: Don’t keep all your money in one place. Divide it between your wallet, money belt, and hotel safe if available.

- Be discreet: Avoid displaying large amounts of cash in public.

- Use hotel safes: If your accommodation offers a safe, use it to store extra cash and valuables.

- Be aware of your surroundings: Especially when using ATMs or exchanging money.

What to Do If Your Card Doesn’t Work

If you find that your card doesn’t work in Thai ATMs, don’t panic. Here are some steps you can take:

- Try another ATM: Sometimes the issue might be with a specific ATM rather than your card.

- Contact your bank: Your card may have been blocked for security reasons. Contact your bank to verify and resolve any issues.

- Use a money transfer service: As mentioned earlier, services like Western Union can be a lifeline in such situations.

- Visit a bank branch: Some banks may be able to help you withdraw cash over the counter using your passport and card.

Understanding Thai Currency

The currency in Thailand is the Thai Baht (THB). Here’s a quick overview of the denominations you’ll encounter:

- Coins: 1, 2, 5, and 10 baht

- Banknotes: 20, 50, 100, 500, and 1000 baht

Be aware that 1000 baht notes can sometimes be difficult to use for small purchases, so it’s a good idea to keep some smaller denominations on hand.

ATM Locations in Thailand

You’ll find ATMs widely available throughout Thailand, especially in urban and tourist areas. Common locations include:

- Banks and their branches

- Shopping malls

- Convenience stores like 7-Eleven

- Tourist areas and popular streets

- Airports and bus stations

In major cities like Bangkok, Phuket, and Chiang Mai, you’ll often find a floor in shopping malls dedicated to banks and ATMs, making it easy to compare options.

I’m Harry – and I was tired of the same old “10 best places I’ve never been but I’m writing about for some reason” blog posts. So… I’m a young traveller on a mission to travel the world and share my true, unfiltered experience, including all the gristly details. From packing my life into one bag for a year, to traveling Vietnam by motorbike, to sorting out Visas for specific countries – I’ve done it all, am doing it all and only give my advice on things I have done – not regurgitated cr*p from another source *cough* most publications *cough*. So bear with us! This project will take some time to grow, and will take a fair bit of money. But I’m determined to make it the single best source of information about traveling on the internet.